QofE Report: 5 Critical Questions You Can’t Ignore

Not all QofE reports are the same. Ask these 5 questions first to avoid risks, uncover real...

You steer. We map the course

We assist clients in identifying, evaluating, and acquiring target companies that align with their strategic goals.

You steer. We map the course

We assist clients in identifying, evaluating, and acquiring target companies that align with their strategic goals.

We expertly examine a target business’s financial statements, debts, cash flow, and other financial metrics to give you a full picture of its financial health and the risks involved. Our QofE report analyzes historical earnings for future projections, examines net income for a true reflection of financial stability, and assesses revenue sources for their nature and sustainability.

We assess key financial metrics to understand the target’s revenue, profit, and overall financial health

We review accounting practices to ensure they meet industry standards and regulatory requirements.

We verify the accuracy of financial adjustments and documentation.

We evaluate the target’s online presence to gather additional business insights.

We update financial calculations and make necessary adjustments to provide an accurate picture of performance.

We check tax returns and payroll data for any inconsistencies.

We identify and assess potential risks and issues that could affect post-acquisition success

Through interviews with key personnel, we gain a clear understanding of the business structure and potential risks.

We analyze significant financial items to ensure their proper representation and impact

We ensure that bank statements align with reported financial data.

We assess key financial metrics to understand the target’s revenue, profit, and overall financial health

We evaluate the target’s online presence to gather additional business insights.

Through interviews with key personnel, we gain a clear understanding of the business structure and potential risks.

We review accounting practices to ensure they meet industry standards and regulatory requirements.

We update financial calculations and make necessary adjustments to provide an accurate picture of performance.

We analyze significant financial items to ensure their proper representation and impact

We verify the accuracy of financial adjustments and documentation.

We check tax returns and payroll data for any inconsistencies.

We ensure that bank statements align with reported financial data.

We identify and assess potential risks and issues that could affect post-acquisition success

We initiate our process with a discovery call to understand your specific needs and objectives, setting the foundation for our partnership.

Following the discovery call, we formalize our relationship with an engagement letter, outlining the scope of services and expectations.

We request relevant data to conduct a thorough review of the target company, ensuring we have all necessary information to proceed.

A kick-off meeting is scheduled to align all stakeholders, discuss the data gathered, and clarify the next steps in the process.

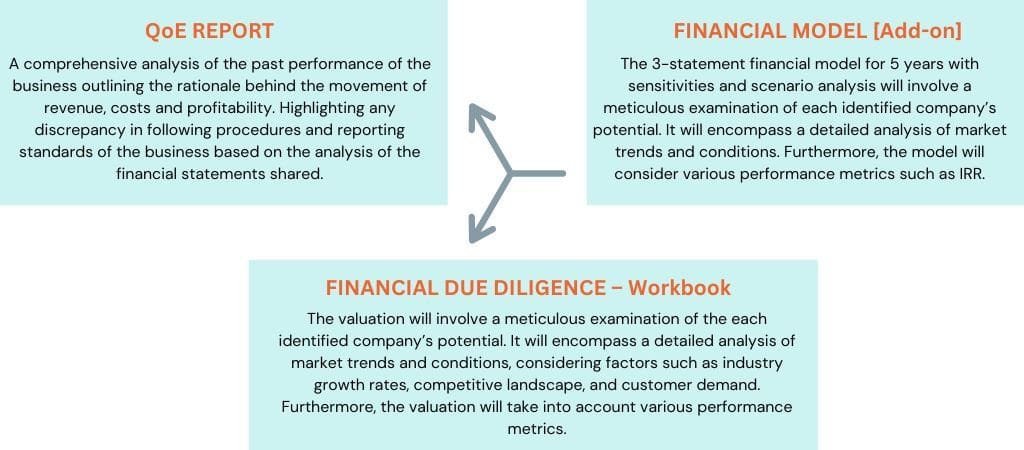

We conduct an extensive financial due diligence process, examining key metrics to assess the target company’s financial health and potential risks.

We offer an optional financial forecast to project future performance and help inform your decision-making process.

We conclude our process with a finalized Quality of Earnings (QofE) report that delivers a clear and reliable understanding of the target’s financial situation, supporting your decision-making process.

Our process is designed to be seamless, transparent, and tailored to unique business needs. From the initial discovery call to the final report, our expert team ensures each step is executed with precision and attention to detail. We prioritize efficiency and clarity, providing you with the insights and confidence needed to make informed decisions

With over a decade of experience in Mergers & Acquisitions, we possess the expertise and insights necessary to guide you through every stage of the acquisition process. From initial strategy and target identification to due diligence and post-acquisition integration, our comprehensive approach ensures no detail is overlooked. Our dedicated team works closely with you to align your strategic goals with the right opportunities, providing tailored solutions that drive value and growth. Whether you’re acquiring or merging, we ensure a smooth, efficient, and successful transition, minimizing risks and maximizing potential

We have successfully guided numerous M&A transactions, assisting clients in navigating complex processes to achieve their strategic objectives

Our team has performed a wide range of Quality of Earnings (QoE) reports, delivering critical insights for informed decision-making and seamless integrations.

Our goal is to reduce transaction risk through technical, financial, and operational analysis. We take a collaborative, responsive approach tailored to each client. On the buy-side, we support private equity, search funds, and strategic buyers. On the sell-side, we work with owners and intermediaries to streamline the process, structure deals effectively, and help maximize after-tax value

We’re proud to support a diverse range of clients in achieving their business goals

Our Client’s Success stories inspire us every day. Each testimonial reflects our journey of commitment, precision, and dedication to exceeding expectations

Closing isn’t the finish line — it’s the start of a new phase. Post-transaction support focuses on integrating operations, aligning financials, and preserving the value created during the deal. From day-one planning to full integration, the right support can make the difference between a smooth transition and missed potential.

Not all QofE reports are the same. Ask these 5 questions first to avoid risks, uncover real...

Discover the acquisitions process for founders in 6 clear steps. From first call to closing, learn how...

Discover how a difference between Quality of Earnings Report vs audit and why QofE is essential for...