5 Essential SMB Reporting Insights Every Business Needs

Small and mid-sized businesses (SMBs) are constantly juggling priorities sales, marketing, hiring, and customer service often take the spotlight. But one powerful tool remains underused in many SMB strategies: reporting.

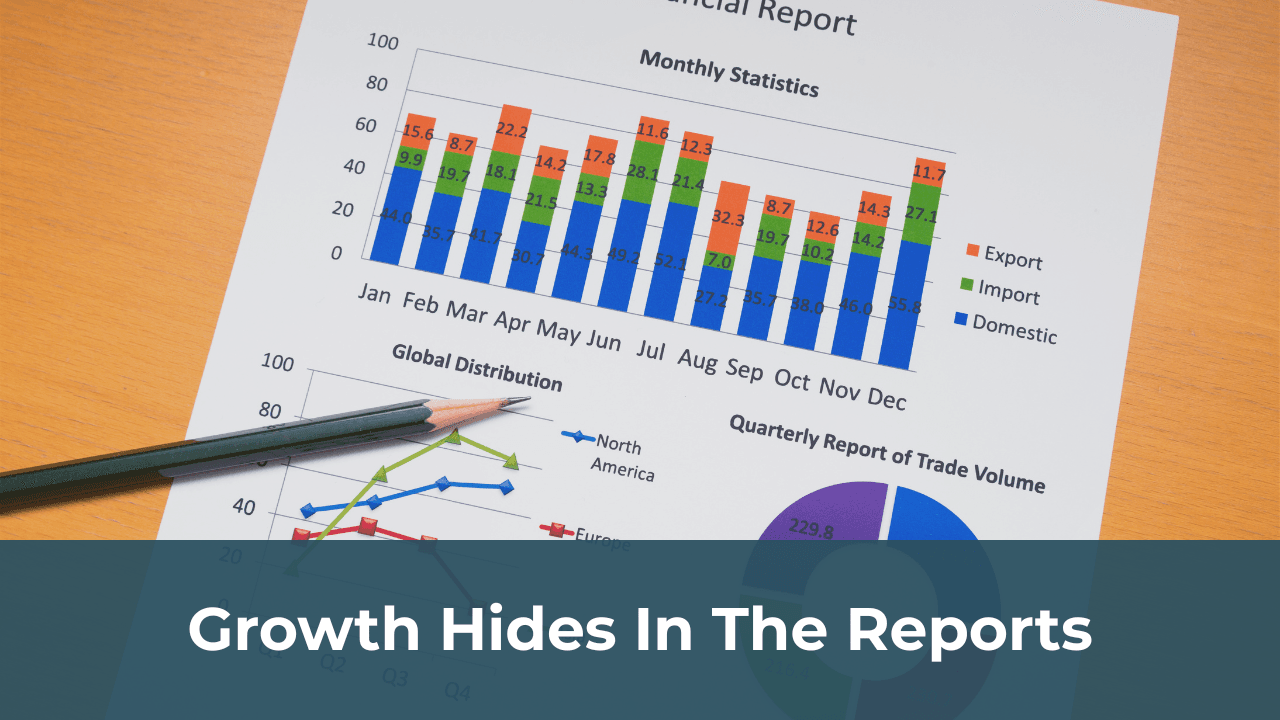

SMB Reporting isn’t just about compliance or bookkeeping it’s the bridge between your daily operations and long-term growth. When done right, financial and operational reporting gives you the insight to make faster, smarter, and more profitable decisions.

In this guide, we’ll explore why SMB Reporting is the missing piece in most SMB strategies, the risks of ignoring it, and how to embed it into your decision-making process.

Why SMB Reporting Is Overlooked

Many small business owners are hands-on operators. Their decisions are based on instinct, experience, or urgency. Reporting is often pushed aside because:

- It feels too “corporate” or complex

- There’s no dedicated finance team

- Owners believe QuickBooks is “enough”

- They’re unsure which reports actually matter

- Time is spent reacting not analyzing

The result? Missed opportunities, hidden costs, and growth that feels chaotic instead of controlled.

What Is SMB Reporting, Really?

Reporting is the structured presentation of key data that reveals your business performance. For SMBs, this usually includes:

- Profit & Loss (P&L) statements

- Balance sheets

- Cash flow reports

- KPI dashboards

- Budget vs. actual summaries

- Revenue, expense, and margin tracking

- Customer and product performance insights

These aren’t just for accountants. They’re tools for leadership.

How SMB Reporting Drives Better Business Strategy

Here’s how structured reporting can dramatically upgrade your business operations:

1. Clear Visibility Into Financial Health

Without regular reports, you don’t know if your business is truly profitable or which products, services, or clients are dragging margins down. Reporting reveals what’s working and what’s not.

2. Data-Driven Decision Making

Gut instinct has limits. Reports provide data that helps you decide when to hire, raise prices, invest in tools, or cut spending. SMBs that use data grow faster and more efficiently.

3. Resource Optimization

Want to cut costs without hurting performance? Reporting helps you track where your money goes so you can redirect it toward high-ROI activities.

4. Stronger Funding & Investment Readiness

Banks and investors need to see accurate, timely reports. If your books are messy, it can cost you the opportunity to raise capital, secure loans, or sell your business later.

5. Improved Team Accountability

When teams have access to KPIs and performance dashboards, they’re more focused and goal-driven. Reporting fosters alignment and transparency across departments.

Signs You’re Missing the Reporting Piece

Not sure if your reporting is lacking? Here are common symptoms:

- You’re unsure of your monthly profit

- You don’t know your best or worst-performing service

- You find surprises at tax time

- Your QuickBooks data is outdated or uncategorized

- You make major decisions without reviewing numbers

- Reports are created, but no one reads or acts on them

If any of these hit home, your reporting needs attention.

Common SMB Reporting Mistakes

Even businesses that try to implement reporting often fall into traps:

- Relying only on P&L and ignoring balance sheet or cash flow

- Using outdated templates that don’t reflect business needs

- Failing to close books monthly

- Manually creating reports in Excel without cross-checks

- Not reviewing or discussing reports in team meetings

The fix? Automate, standardize, and review regularly.

Real SMB Impact: A Reporting Turnaround

One California-based service company came to VASL with six months of uncategorized expenses and no reporting structure. They were profitable but couldn’t prove it to lenders or partners.

Our team stepped in, cleaned and reconciled accounts, built a monthly reporting package, and added a KPI dashboard in Google Sheets.

The result?

- A $40,000 line of credit secured within 30 days

- Identified two underperforming clients draining resources

- Saved 15 hours per month on manual reporting

You can read more here → VASL Reporting Services

What Reports Should SMBs Prioritize?

Not all reports are created equal. Start with these essentials:

- Monthly P&L: Understand income vs. expenses

- Balance Sheet: Track assets, liabilities, and equity

- Cash Flow Statement: Monitor real-time liquidity

- Budget vs. Actual: Identify overspending or revenue gaps

- KPI Dashboard: Focus on what matters most like gross margin, CAC, or revenue per employee

Bonus: Reports segmented by product, location, or client help uncover new insights.

How to Integrate Reporting for SMBs

Step-by-step:

- Use cloud-based accounting (QuickBooks, Xero, Zoho Books)

- Reconcile accounts monthly don’t skip this

- Set a regular reporting cadence (weekly, monthly, quarterly)

- Automate dashboards using Google Sheets or Power BI

- Review reports with your team and take action

- Outsource report creation if needed accuracy matters

Don’t treat reporting for smbs as an afterthought. Make it your decision-making engine.

Why SMBs Are Outsourcing Reporting in 2025

Reporting doesn’t have to mean hiring a full-time CFO. Many businesses are outsourcing it to firms like VASL for:

- Monthly close and reporting

- U.S.-compliant financials

- Dashboard creation and tracking

- Vendor-neutral software setup

- Actionable insights from expert analysts

It’s cheaper, faster, and far more effective than trying to DIY without expertise.

Final Thoughts: Don’t Let Reporting Be an Afterthought

If you’re focused on growing your small business, reporting must be part of your strategy.

It:

- Prevents expensive mistakes

- Uncovers your real growth drivers

- Prepares you for funding and tax season

- Builds trust with partners and your team

- Turns chaos into clarity

Without SMB Reporting, strategy is guesswork. With it, you make better decisions, faster.

Let’s Talk

Need help building a SMB Reporting system that supports real growth?

Email us anytime at saman@vasl.team

Book a free call: Here